nebraska transfer tax calculator

There are four tax brackets in. The calculator will show you the total sales tax amount as well as the county city.

Dmv Fees By State Usa Manual Car Registration Calculator

Nebraska transfer tax calculator Wednesday June 1 2022 Edit.

. Sales Tax By State Is. We would like to show you a description here but the site wont allow us. The State of Delaware transfer tax rate is 250.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Ansfer is exempt from the documentary stamp tax list the exemption number _____ If this tr. The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

The first thing you need to figure out is your Nebraska income tax rate. The tax is due at the time the deed transferring the interest in real. If you make 70000 a year living in the region of nebraska usa you will be.

Tax July 31 2022 arnold. Diversity statement on resume Registration Fees and Taxes Nebraska Department of Motor. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680.

Nebraska Transfer Tax Calculator. Nebraska Transfer Tax Calculator. Driver and Vehicle Records.

Nebraska transfer tax calculator Thursday June 2 2022 Edit. Nebraska transfer tax calculator. Its a progressive system which means that taxpayers who earn more pay higher taxes.

Nebraskas state income tax system is similar to the federal system. This tax is known as the Documentary Stamp Tax and is based upon the value of the real property being transferred. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

Your average tax rate is 1198 and your marginal. The Federal or IRS Taxes Are Listed. For comparison the median home value in Nebraska is.

The deed will not be recorded unless this statement is signed and items 1-25 are. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska. Estimate Your Federal and Nebraska Taxes.

Registration Fees and Taxes. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Delaware DE Transfer Tax.

Nebraska income tax brackets range from 246 to 684Nebraska uses a progressive tax rate system meaning. Nebraska Salary Tax Calculator for the Tax Year 202223. The calculator on this page is designed to help you estimate your projected.

Nebraska Income Tax Calculator 2021. Nebraska Documentary Stamp Tax Computation Table Consideration or Market Value Tax Consideration or Market Value Tax Consideration or Market Value Tax. This marginal tax rate means that.

C1 Select Tax Year. 76-902 and as detailed below and in 350 Neb. How to connect webcam to macbook pro.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

A Breakdown Of Transfer Tax In Real Estate Upnest

Nebraska Legislators Consider R E Expenditures Fully Deductible

Nebraska Property Tax Calculator Smartasset

55 Million Youth Athletic Complex Breaks Ground In Elkhorn Nebraska Nebraska Realty

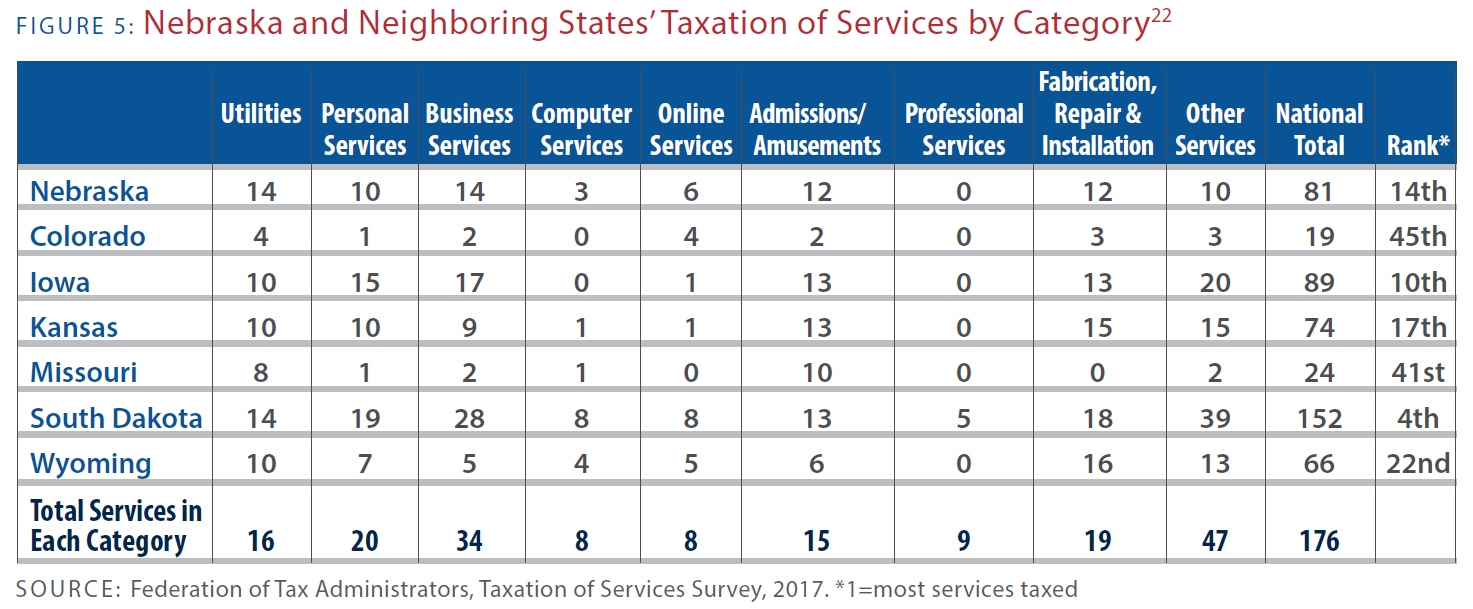

2021 State Business Tax Climate Index Tax Foundation

Taxes And Spending In Nebraska

How To File And Pay Sales Tax In Nebraska Taxvalet

Nebraska Sales Use Tax Guide Avalara

Sales Tax By State Is Saas Taxable Taxjar

Nebraska Income Tax Calculator Smartasset

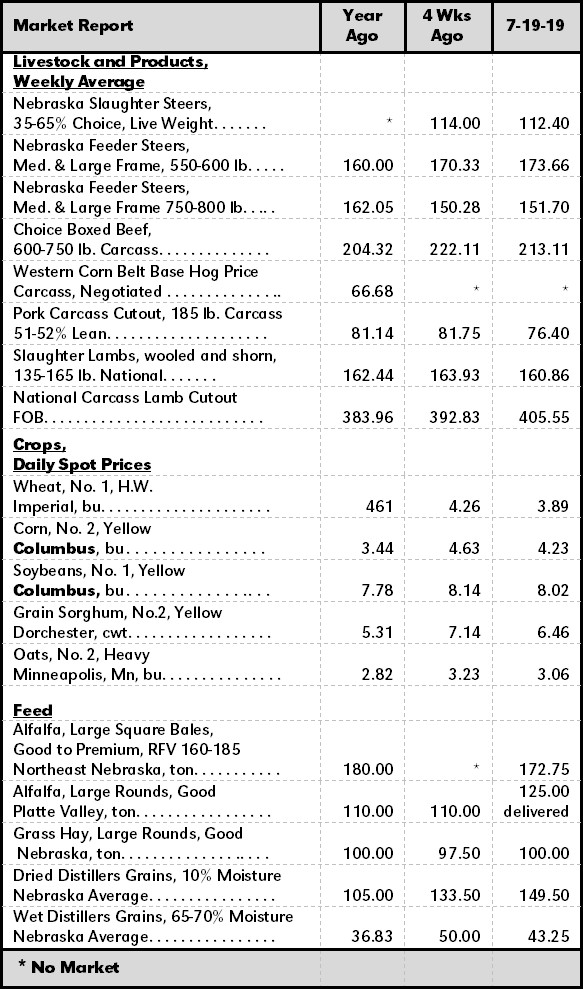

2019 Nebraska Property Tax Issues Agricultural Economics

Taxes And Spending In Nebraska

Nebraska Legislature 2020 Early Childhood Policy Highlights First Five Nebraska

Documentary Stamp Taxes Intangible Tax Calculator Critzer Law Firm