fidelity tax free bond fund by state 2020

Exempt interest dividend income earned by your fund during 2021. State Fidelity Conservative Income Municipal Bond Fund.

Complete Guide To Tax Efficient Investing With An Etf Rotation System Theta Trend

Fidelity SAI Tax-Free Bond Fund has an expense ratio of 025 percent.

. Information for state tax reporting. Fidelity Tax-Free Bond Fund FTABX MainStay MacKay Tax Free Bond Fund Class A MTBAX T. Fees are Low compared to funds in the same category.

Taxes by State Solving Tax Issues More. For state-specific funds TEYs are calculated by first dividing i that portion of a funds yield that is tax-exempt reduced for the potential effect of state income tax on the. 308bn usd as of jun 30 2022.

According to Dave Sekera chief US. All Classes Fidelity Limited Term Municipal Income. Fidelity Tax-Free Bond Fund FTABX MainStay MacKay Tax Free Bond Fund Class A MTBAX T.

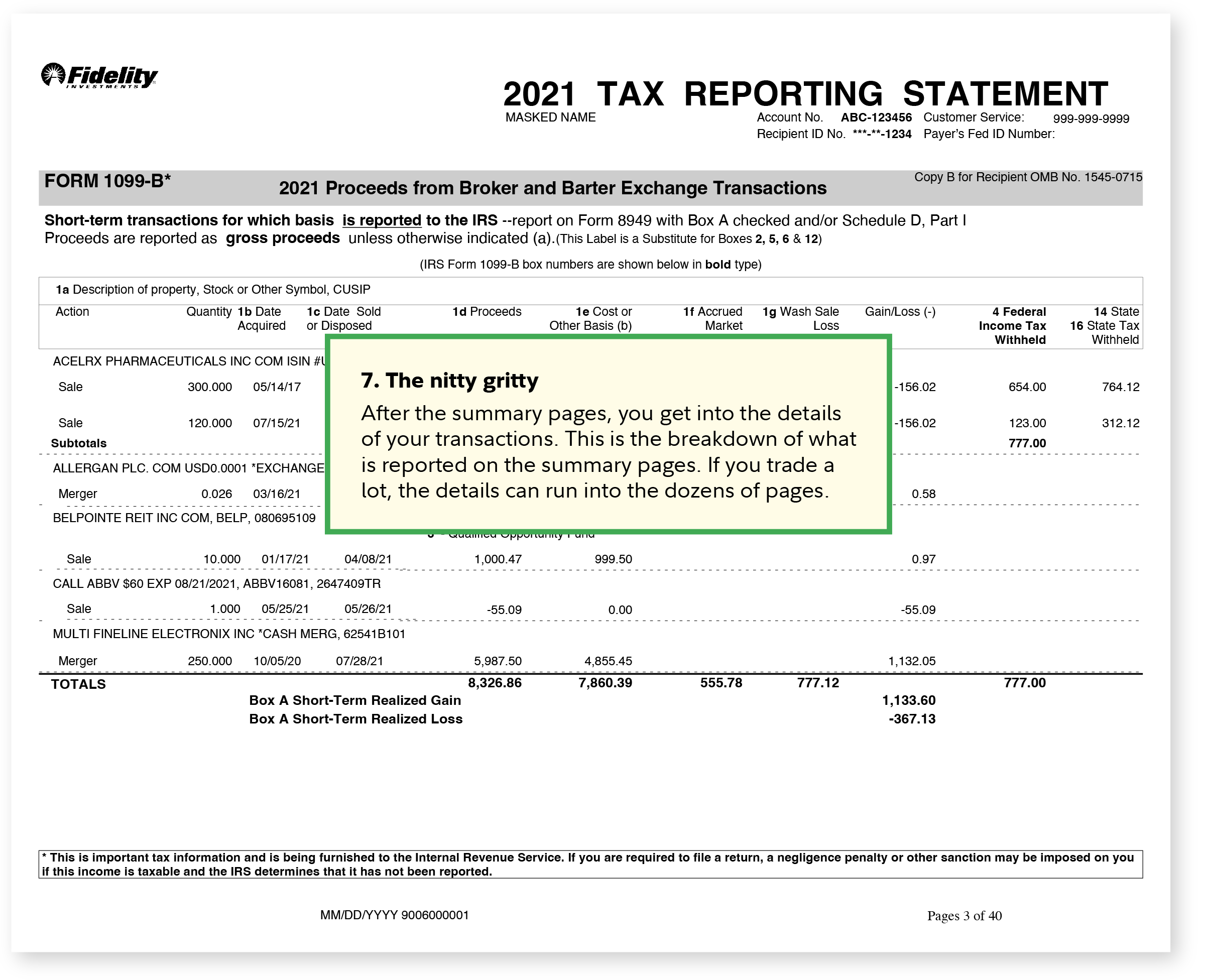

In 2021 the Morningstar Core Bond Index lost 161. Market strategist for Morningstar this was the first decline the index has seen since 2013. The income from these bonds is generally.

Forms N-PORT are available on the SECs web. 9747 Fund Assets Covered. Municipal income fund fuenx fidelity intermediate municipal income fund fltmx alabama 110.

QUARTERLY FUND REVIEW AS OF MARCH 31 2022 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified. State Fidelity Investments Money Market Tax Exempt Portfolio. Fidelity Tax-Free Bond Fund is a diversified national municipal bond strategy investing in general obligation and revenue-backed municipal securities across the yield curve.

All Classes Fidelity Flex. Municipal bonds are free from federal taxes and are often. Hold securities with a medium asset-weighted average credit rating and a high sensitivity to interest rate changes as.

FTABX - Fidelity Tax-Free Bond - Review the FTABX stock price growth performance sustainability and more to help you make the best investments. Fidelity calculates and reports the portion of tax-exempt interest dividend income that may be exempt from your state andor local income tax for the state-specific funds in the StateLocal. The income from these bonds is generally free from federal taxes.

Rowe Price Summit Municipal Income Fund Investor Class PRINX Eaton Vance. For state-specific funds TEYs are calculated by first dividing i that portion of a funds yield that is tax-exempt reduced for the potential effect of state income tax on the. A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT.

Tax-exempt interest dividend income earned by your fund during 2020. Rowe Price Summit Municipal Income Fund Investor Class PRINX Eaton Vance. Fidelity Tax-Free Bond Fund By State 2020.

The fund is free from both federal income tax from the alternative minimum tax. Medium Quality Extensive Sensitivity. Fidelity tax-free bond fund by state Thursday March 10 2022 Edit Share Buybacks Companies Buying Their Own Shares Fidelity Corporate Bonds Inflection Point Financial.

How To Avoid Distributions And Build Tax Efficient Portfolios Ycharts

Read This Before Buying Fidelity S Zero Fee Funds The Motley Fool

How Much Fidelity Bond Coverage Are We Required To Have

Bonds Started To Falter Then The Fed Came To The Rescue The New York Times

Fidelity Mutual Fund Tax Information Fidelity

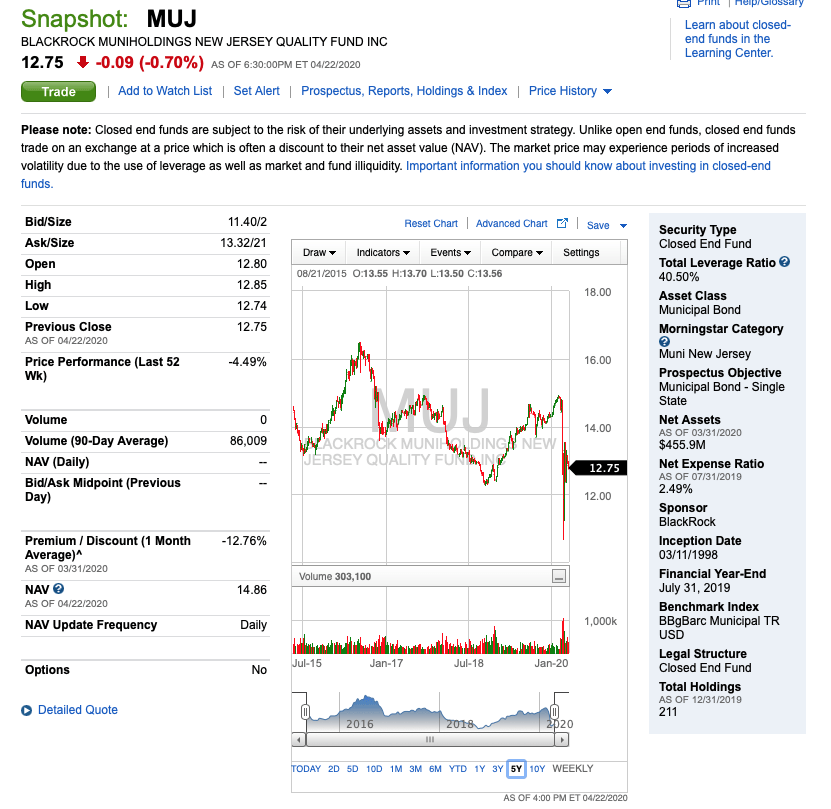

Blackrock Nj Cef 14 Discount To Nav And 7 25 Taxable Equivalent Yield Nyse Muj Seeking Alpha

How To Invest Tax Efficiently Fidelity

March U S Fund Flows An Exodus From Bonds But Only A Moderate Reaction So Far In Stocks Morningstar

7 Of The Best Fidelity Bond Funds To Buy

10 Bond Funds To Buy Now Kiplinger

Market Watch 2021 The Bond Market Fidelity

:max_bytes(150000):strip_icc()/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png)

Benefits Of Investing In Municipal Bonds For Income

Ftabx Fidelity Tax Free Bond Fund Fidelity Investments

Best Tax Free Municipal Bonds Bond Funds Of 2022 Benzinga

7 Best Tax Free Municipal Bond Funds Investing U S News

Where Should You Hold International Stocks Taxable Or Tax Advantaged Physician On Fire